Financially Quantified Value Propositions

Every executive talks about value propositions, but according to McKinsey and our own research, fewer than 5% of companies have one, in spite of knowing they need it. Accordingly, one of the principal issues facing marketers is their perceived lack of accountability. The consequence of this is the Finance tends to dominate the Boardroom, whilst marketing is sidelined to look after digital and promotion.

In today’s highly competitive markets, Boards of Directors are increasingly looking to their senior colleagues for proof that their strategies and expenditure will result in financially quantified value propositions. The process to articulate financially quantified value proposition is the ultimate step in the quantification of the total cost of ownership, and how a supplier can not only demonstrate how they can help their customer to avoid disadvantage, but more importantly, how they can help their customer to create advantage.

Essentially, a value proposition quantifies in financial terms the value the customer receives from dealing with the supplier. It is about four things: a) added value (e.g. revenue gains, productivity improvements etc.); b) cost reduction; c) cost avoidance; and d) risk reduction.

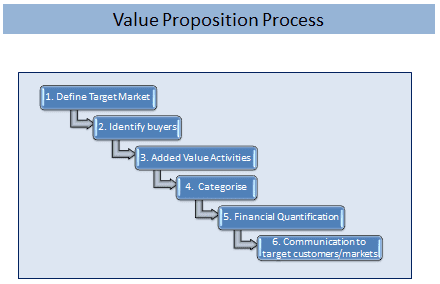

Our process, illustrated in the figure, is crucial in today’s competitive marketplace, where all products and services are excellent, as suppliers have a choice of what to buy. Our research shows that they will select suppliers who can differentiate their value proposition and prove the financial benefits of choosing them.

The financial quantification of value propositions has been developed over many years of research, and successfully tested on many organisations, big and small. It can be run either as a workshop, or as a consultancy assignment. The CFO, the CMO, and a small number of colleagues in marketing, sales, operations and finance will be involved in a one day workshop. We quantify financially the value to customers. The outcomes and conclusions are often reached following further work/analysis by the multi- disciplinary team. Post workshop, we engage with the team and coach its members at all stages of the process.

About Malcolm McDonald Consulting

The fees for the workshop, coaching and subsequent consulting support would reflect the time and effort required for customisation and pre planning work. Engagement of our team of consultants with client organizations and businesses usually results in an increase in net profits of up to 10%.

Two Action Points:

Assess the need in your team and business unit, in current business context.

- Action: Bring together a multidisciplinary team, from marketing, sales, operations and finance, and discuss the business value and the Dollar value of your offering to key customers.

Assess the nature of the support you may need to address the key issues identified.

- Action: Meet our senior consultants to discuss the value proposition offered to a particular business partner; agree the best course of action and resources needed to work with us.