Success today in commercial markets is measured in terms of Shareholder Value Added (SVA), having taken account of the cost of capital, the time value of money and the risks associated with an organisation’s strategy. In today’s highly competitive markets, Boards of Directors are increasingly looking to their senior marketing colleagues for proof that their strategies and expenditure will result in SVA.

Marketing Due Diligence is a detailed process developed over many years of research at Cranfield University School of Management, as a result of close collaboration between the Finance and Marketing groups. It triggers a new type of conversation that matters to the Board, and will bring a new, positive attitude towards marketers and what they do. Essentially, Marketing Due Diligence is about six things:

- Assessing the risk of market forecasts.

- Assessing the risk of market strategies.

- Assessing the risk of the profit plan.

- Recalculating the resulting net free cash flows.

- Calculating whether these result in shareholder value added.

- Presenting these results to the Board.

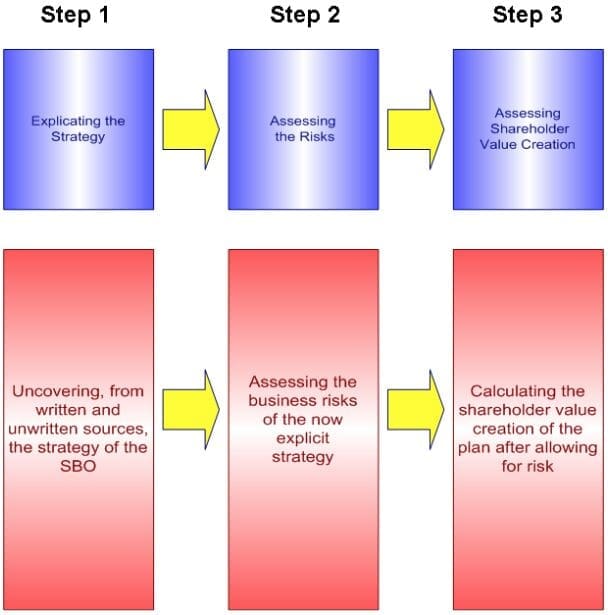

We engage with the CFO, the CMO and a small number of colleagues in marketing and sales, to ensure that the process of risk assessment is rigorously implemented. The process, illustrated in the figure above, is typically run during an in company workshop over a couple of days. During the workshop, the existing strategy of the business unit will be tested, and forecast net free cash flows adjusted.

The output consists of: a) a rigorous review of the market; b) a robust, risk-assessed strategy that can be presented to the Board and investors; and c) a profit plan to prove that over the planning period (typically three years) SVA is being created. Nota bene, the strategy has to be revisited, if proven that it actually destroys shareholder value.

About Malcolm McDonald Consulting

The fees for the workshop, subsequent coaching sessions and consulting support would reflect the time and effort required for customisation and pre planning work. Engagement of our team of consultants with client organizations and businesses usually results in an increase in net profits of up to 10%.

Two Action Points:

Marketing Risk and Due Diligence is a new type of conversation that matters to the Board.

- Action: Bring together a multidisciplinary team, from marketing, sales and finance to discuss various kinds of business risks and their impact on the present and future cash flows.

Assess the nature of the support you may need to address the key issues identified internally.

- Action: Meet our senior consultants to discuss and assess if the predicted net free cash flows will accrue; agree the best course of action and resources needed to work with us.